INVEST IN UK PROPERTY

Capital Growth:

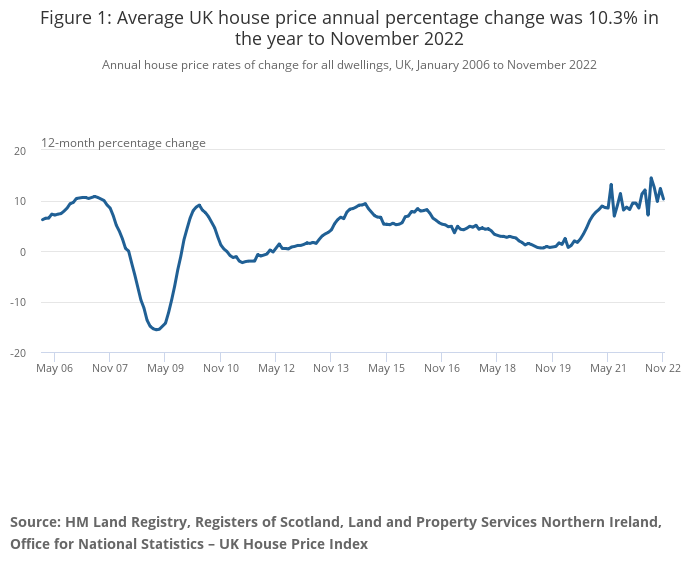

In the past five years, UK properties have increased at an average 5% (4.7%) annually.

-

the average UK house price is now £285,579 compared to £272,778 a year ago, a rise of £12,801.

-

annual house price growth is 4.7% (year to November 2022), having peaked at 12.5% in June 2022, which was the strongest rate of annual growth since January 2005.

-

average property prices are £46,403 (19.4%) higher than at the onset of the pandemic.

-

a new record high average property price was set in August 2022 (£293,992).

-

the typical UK house price has increased by 71% over the last decade.

Source: Halifax and Rightmove

Why invest in UK property?

Source: Gov.uk

Globally comparable indicated UK was 1.9% across other cities and predicted for steady trajectory.

Source: Saville

Rental Growth:

Private rental prices paid by tenants in the UK rose by 4.2% in the 12 months to December 2022, up from 4.0% in the 12 months; why, more demand than supply.

Yields:

-

Rental yields are high, demand for rental properties predicted to grow, which is good news for investors, utilise rental income for cash flow. Buy to let market is still strong and has stand the test of time; continued to be important investment.

Supply vs demand:

-

The UK needs about 300,000 new homes each year, just to meet demand. But the latest data suggests that supply rarely tops 200,000 – especially since the Covid 19 pandemic.

-

There’s a housing shortage within the UK property market, which has left a significant gap between supply and demand levels.

-

Property challenges means huge demand for rental properties (tenants consider paying more due to limited housing stock). Resulting in buy-to-let investment opportunity.

-

High demand also means UK rents are rising.

Property Strategies:

-

Different property investment strategies, housing stock types provide opportunity for sophisticated investors to select from a range of budgets and strategy options.

Funding options:

-

Various products on the market, could leverage your investments such as buy-to-let. Majority of banks and mortgage broker/lenders (criteria checks required) can provide loans to build your property investments.

Passive income:

-

Buy-to-let can be a great regular source of income for years to come. The average UK rental yields vary from 3.6~5% pending on regions of the country, however, some places peaked into double figures, which means impressive rental returns in the UK market.

-

Opportunity for buy-to-let investment could have the potential short-term income and capital rental growth in the long-term.

Risk / Opportunity:

Depends on how you seen the world, some see opportunity where others see risk. I would be lying if I said “there’s no risk” investing in property. However, planning for risks based on tactic knowledge of the market provide model or strategy which can be implemented to mitigate or minimise the risk (if it occurs); worst case scenario would be sell the asset.

Property does have its downside, the market is generally cyclical and will go through periods of decreasing value. While this may impact some shorter-term investors, in the long-term, property has generally been seen to increase in value.

Property isn’t like any other asset, because it’s based on human basic needs.

In challenging economic environments, people still need shelter, warms, food and security; coupled with limited housing stock means demand for rented accommodation remain high. In addition, high than normal cost of living could results in slow down purchase of properties, ergo, increases the demand for high-quality rental properties.

Take into consider the recession that followed the financial crash in 2008, after two years of decline, UK buy-to-let bounced back and recovered.

This kind of stability and downside protection is fairly unique to property – compared with other asset classes, which are more volatile.

The UK is headed for its highest rate of inflation in decades – with some predicting rates into double figures (highest since 1991) early 2023. Mitigation measure to consider – property investments can be great opportunity against high inflation.

In summary, property prices (capital growth) and rental income tend to rise with inflation. ONS Housing data shows that UK property tends to appreciate by about 3-5% every year including rental (rental growth).

-

We provide a swift, fast service to buy your home directly or through trusted sellers.

On/off-market buy-to-let property deals.

-

BRRR (Buy, Refurb, Re-finance, Rent out)

-

Flip - Buy, Refurb, Sell.

-

BTL (Buy to Let) - Rent out a property

Property Sourcing & Deal Packaging.

-

Property Sourcing - We find the deal and hand it over to you for a fee.

-

Deal Packing - We find the deal and project manage the end to end process for a fee.

House in Multiple Occupation (HMO)

-

Property sourcing & Deal Packaging.

-

BRRR (Buy, Refurb, Re-finance, Rent out)

-

Flip - Buy, Refurb, Sell.

DGS Asset Property Trading are cash buyers, one of the fastest way to complete the sale of your property.

Alternative solution, if you want to stop repossession of your house, or are selling a house after divorce.

Services Provided by our Trusted Partners.

-

Rent to Rent (R2R).

-

Service Accommodation (SA).

-

Commercial, or Commercial to Residential.

-

Off Market Plans/New Development

BENEFITS

HANDS OFF INVESTMENT

We provide our sophisticated investors high quality, tailored made, scalable and trackable service based on defined strategy.

INVESTMENT COMPARABLES

We carryout comparable to ensure informed decision from sophisticated investors, to align to agreed strategy.

GIVING BACK

Providing quality stock to be rented within the local community; social housing also considered.

HEALTH & WELL BEING

Investing can be a stressful situation, we can manage the process for you, so you can focus on your health and well being

THERE ARE MANY WAYS TO INVEST IN UK PROPERY. CHOOSE YOUR OWN PATH.

OPPORTUNITIES

Quote from billionaire investor Warren Buffett said "Time: It's the only thing you can't buy"

Quote from Danny Swaby "We are all gifted with the ability seek/find opportunities.

Opportunities are all around us, it's whether you can see it, understand it (when others cannot see it yet) , have the time to pursue it, monetised it and to act on it".